The question of which nation can be considered the best country for startups has become a central theme in international economic development. The landscape of global entrepreneurship has shifted significantly during the past decade, driven by new patterns of investment, rapid digital transformation, demographic changes, and national innovation policies. As governments worldwide attempt to position themselves as modern innovation hubs, the competition to be recognized as the best country for startups grows increasingly intense. This article provides an analytical, structured, and academically grounded examination of how global startup ecosystems evolve and what criteria define the best environments for new ventures. It also offers an updated perspective on the countries and regions that are shaping the entrepreneurial landscape in 2026.

Understanding the Criteria for Startup Competitiveness

Any evaluation of the best country for startups requires a clear framework for understanding the core factors that influence entrepreneurial success. Economic stability, access to capital, regulatory flexibility, infrastructure readiness, and talent availability form the foundation of a successful startup ecosystem. Each of these dimensions contributes to the ability of founders to build, scale, and sustain new ventures within a competitive global environment. Countries that aspire to become the best country for startups must demonstrate consistent performance across these pillars and continuously evolve to meet the needs of rapidly transforming industries.

Economic Foundations of Startup Growth

A stable economic environment serves as the first indicator of whether a nation can realistically compete for the title of best country for startups. Entrepreneurs require predictable monetary policy, manageable inflation, and supportive financial institutions. Economic resilience enables founders to weather early uncertainties and helps attract venture investors seeking long term value. Throughout the past decade, countries that invested in macroeconomic stability have demonstrated stronger startup performance, highlighting the relationship between economic foundations and innovation outcomes.

Access to Venture Capital

The availability of venture capital remains a critical determinant in identifying the best country for startups. Investors assess markets based on liquidity, exit potential, and the maturity of financial networks. When venture capital systems expand, entrepreneurs benefit from improved funding opportunities, reduced financial barriers, and faster paths to scale. Nations that once held dominant positions in global venture financing now face increasing competition from emerging markets that have rapidly grown their investment capacity. This redistribution of capital has changed global startup dynamics and influenced which countries qualify as the best country for startups in the current decade.

Regulatory Environment and Ease of Doing Business

A flexible regulatory environment plays a central role in shaping the attractiveness of a nation as the best country for startups. Entrepreneurs must navigate licensing processes, labor rules, tax compliance, and corporate governance structures. Simplified regulations reduce operational friction and allow founders to focus on innovation. Countries with cumbersome regulatory procedures often struggle to compete with nations that maintain streamlined systems designed to support rapid business formation and expansion. The modern startup ecosystem benefits from governments that employ digital platforms, transparent legal processes, and predictable policy frameworks.

Talent Availability and Workforce Competencies

Talent remains a defining characteristic of the best country for startups. Innovation driven companies require skilled workers in software engineering, artificial intelligence, data science, design, finance, and operations. The global distribution of talent has shifted due to remote work adoption and the expansion of digital education systems. Nations with strong universities, accessible immigration policies, and competitive labor markets tend to outperform others in the race to become the best country for startups. Workforce education, digital literacy, and technical training contribute directly to the pace of new venture creation and growth.

Infrastructure for Digital and Physical Scaling

Infrastructure strength helps determine whether a country can realistically be the best country for startups. Digital infrastructure includes high bandwidth connectivity, cloud availability, cybersecurity maturity, and national data policies. Physical infrastructure includes transportation systems, logistics efficiency, and modern office or research facilities. Countries that invest consistently in these areas create conditions that support sustainable entrepreneurial growth. As the global economy becomes more digital, the nations that maintain advanced digital infrastructure gain significant advantages.

Innovation Culture and Entrepreneurial Mindset

Cultural attitudes toward risk taking and experimentation significantly influence a country’s potential to serve as the best country for startups. Environments that reward creativity, support failure as part of the innovation process, and encourage early stage ideation develop stronger entrepreneurial cultures. Innovation ecosystems also rely on mentorship networks, startup acceleration programs, and community organizations that provide guidance to new founders. A country that fosters an active innovation culture gains a competitive position in the global startup economy.

Government Policy and National Innovation Strategy

Public policy remains one of the strongest drivers of national competitiveness in the search for the best country for startups. Innovation incentives, research funding, tax benefits, and technology investment programs directly influence entrepreneurial activity. Governments that treat startups as strategic economic assets tend to implement policies that stimulate early stage growth and international investment. The emergence of national AI strategies, digital economy frameworks, and sovereign innovation funds illustrates how governments attempt to shape long term entrepreneurial ecosystems. Such strategies are essential for nations aspiring to become the best country for startups in the coming decade.

Geographic Concentration and the Role of Global Cities

Startup activity increasingly concentrates in global megacities rather than entire nations. Cities such as Singapore, Dubai, San Francisco, Bangalore, and Shenzhen act as independent innovation engines with their own ecosystems, regardless of national borders. When evaluating the best country for startups, analysts now consider the influence of individual cities within each nation. These cities function as gateways for investment, talent, and technological research. Their performance often determines how a country ranks in global startup competitiveness indexes.

Asia’s Rapid Ascendance in Global Startup Rankings

The rise of Asian economies significantly reshaped conversations about the best country for startups. China, India, Singapore, and Indonesia expanded their startup ecosystems through accelerated investment and large scale digital adoption. China’s technology clusters in Beijing, Shanghai, and Shenzhen became global powerhouses. India’s Bangalore emerged as a central hub for software innovation, fintech growth, and artificial intelligence development. Singapore established itself as a regulatory leader with strong corporate governance standards. These developments positioned Asia as a key contender in the global search for the best country for startups.

Southeast Asia as a High Growth Region

Southeast Asia experienced some of the highest growth rates in venture capital investment during the past five years. Markets such as Indonesia, Vietnam, and Malaysia benefited from demographic expansion, mobile first adoption, and government sponsored digital transformation programs. The region’s consistent increase in startup density and rapid rise of unicorn level companies highlight its strategic position in discussions related to the best country for startups. International investors increasingly target Southeast Asia as a high return region due to favorable economic conditions and a young digital workforce.

The Middle East and the Rise of Innovation Capitals

The Middle East transformed into a significant competitor for the title of best country for startups. Cities such as Dubai, Abu Dhabi, and Riyadh expanded their ecosystems through government backed innovation funds, zero tax policies, AI acceleration programs, and the attraction of foreign talent. The region’s strategic location, growing financial hubs, and advanced digital infrastructure contributed to its emergence as a global startup center. Many founders now view the Middle East as a strong contender in the ongoing debate regarding the best country for startups.

Europe’s Stable but Slower Growth

Europe maintains strong startup ecosystems in cities such as London, Berlin, Paris, and Stockholm. The continent offers advanced research institutions, skilled talent pools, and well developed regulatory frameworks. However, its growth rate remains slower compared to regions undergoing rapid digital expansion. Europe’s strengths lie in deep tech, biotech, and fintech research, but regulatory complexities sometimes limit the speed of venture formation. These conditions influence its comparative position when evaluating the best country for startups.

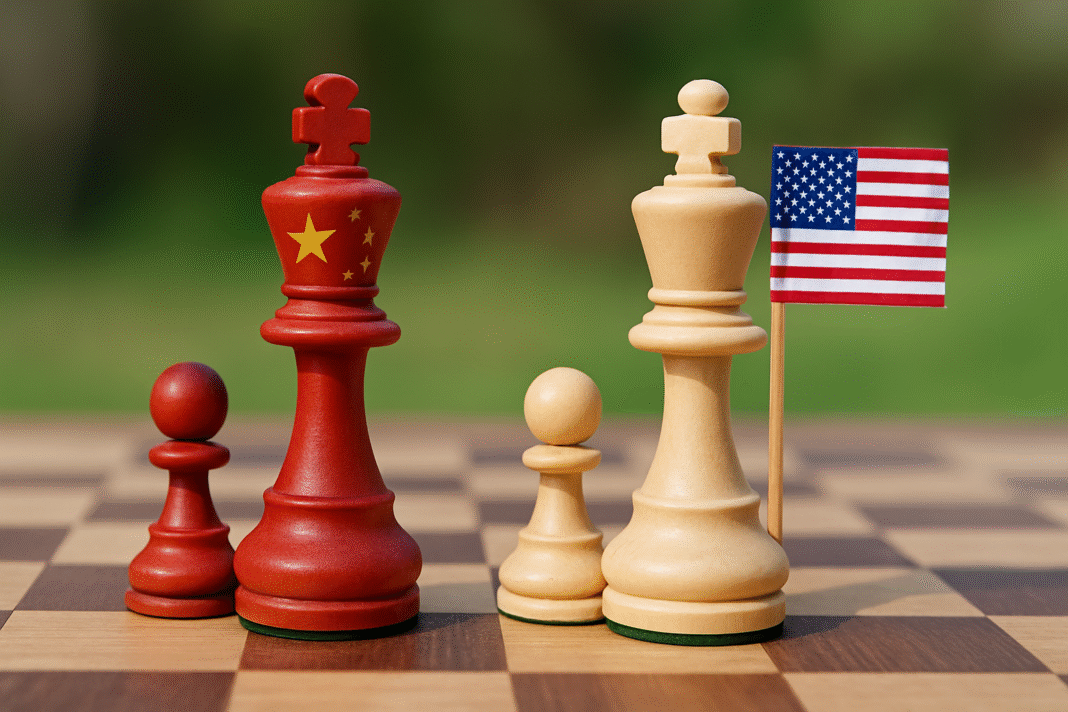

North America’s Evolving Position

The United States and Canada continue to hold significant influence in global innovation. Silicon Valley, New York, Toronto, and Austin remain powerful hubs for technology development. However, the distribution of global venture capital has shifted, reducing the United States share and changing perceptions of whether it remains the best country for startups. The American market retains strong advantages in talent, research institutions, and investor networks, but faces increasing competition from Asia and the Middle East. This transition reflects a broader move toward a multipolar global startup ecosystem.

Access to Global Insights and Research

Entrepreneurs evaluating global markets often rely on research resources that provide insights into startup trends. Analysts studying the best country for startups can explore additional global research through the insights section available at startupik.

Comparative Evaluation of Global Startup Ecosystems

When examining which nation can be considered the best country for startups, it is essential to conduct a comparative evaluation of global ecosystems based on standardized metrics. These metrics include capital availability, innovation capacity, regulatory frameworks, infrastructure quality, talent accessibility, cultural support, and technology adoption rates. By analyzing these dimensions, researchers can construct a meaningful comparison between countries that consistently appear in international startup rankings. This comparative approach provides a structured pathway for determining how each region contributes to the broader competition for the title of best country for startups.

The Role of Venture Capital Flows in Global Rankings

Venture capital flow is one of the most reliable indicators of the strength of a startup ecosystem. Nations that attract capital demonstrate the economic confidence required to scale new ventures. In the analysis of the best country for startups, it becomes clear that global venture capital flows have shifted significantly during the last decade. The rise of China, India, and Southeast Asia has disrupted the long standing dominance of North American markets. These shifts show that capital efficiency, rather than capital volume, increasingly determines which nations are seen as strong contenders for the best country for startups.

The Influence of Government Policies on Entrepreneurial Competitiveness

Government initiatives strongly influence startup success. Policies that encourage innovation, reduce regulatory friction, and support digital adoption improve national competitiveness. Countries that develop national strategies for artificial intelligence, renewable energy, biotechnology, and financial technology significantly increase their chances of becoming the best country for startups. Governments that combine tax incentives, research funding, and talent mobility policies create environments that help entrepreneurs navigate early stage challenges. Policy effectiveness is therefore a critical factor in determining which regions rise toward the status of best country for startups.

Innovation Density and National Research Productivity

Research productivity and patent generation serve as measurable indicators of innovation density. Nations with strong university networks and high levels of research output often produce more successful startups. Laboratory infrastructure, research clusters, and collaborations with industry leaders strengthen a nation’s position in the global race to become the best country for startups. Countries that integrate research institutions with startup accelerators and venture studios see higher rates of technology transfer and commercialization.

Talent Mobility and International Founder Attraction

Global talent mobility plays a central role in identifying the best country for startups. Countries that welcome international founders and highly skilled professionals experience stronger startup growth. Immigration systems that streamline visas for technologists, researchers, and entrepreneurs contribute positively to national competitiveness. Nations that restrict immigration or impose complex residency requirements struggle to attract top global talent, reducing their potential to rank as the best country for startups. Talent mobility therefore remains one of the strongest predictors of long term entrepreneurial success.

Digital Transformation as a Driver of Startup Growth

Digital transformation continues to reshape modern economies and influences which nations can be considered the best country for startups. Countries that adopt cloud computing, automation, cybersecurity frameworks, and artificial intelligence on a national scale move ahead in global competitiveness. Digital government systems, e payments, open data platforms, and national cloud strategies strengthen entrepreneurial foundations. Nations that lag behind in digital readiness experience slower startup formation rates and reduced international investment interest. As digital transformation accelerates, the ability to innovate within digital ecosystems becomes a defining quality of the best country for startups.

Evaluating Asia’s Position in 2026

Asia remains one of the most dynamic regions in the global startup landscape. China, India, Singapore, South Korea, and Indonesia all demonstrate strong performance across multiple startup metrics. Beijing and Shanghai continue to lead in venture capital volume. Bangalore remains a leading destination for software development, AI engineering, and fintech innovation. Singapore stands out for regulatory stability, financial integrity, and global connectivity. Indonesia has emerged as a significant market due to rapid population growth and technological adoption. These conditions position Asia as a highly competitive region in the search for the best country for startups.

India’s Expanding Role as an Innovation Powerhouse

India represents one of the fastest growing startup ecosystems in the world. Its large population, digitally literate workforce, and expanding consumer markets create favorable conditions for entrepreneurs. Cities such as Bangalore, Hyderabad, and Delhi NCR attract global talent and investment. The government’s fast moving digital initiatives and its growing fintech and SaaS sectors push India closer to recognition as the best country for startups. The national focus on emerging technologies, startup grants, and digital public infrastructure increases India’s position in global entrepreneurship rankings.

Southeast Asia as a High Potential Cluster

Southeast Asia benefits from its demographic advantages, rising middle class, and mobile first consumer behavior. Indonesia, Vietnam, and the Philippines have seen a surge in startup activity due to digital financial inclusion, logistics innovation, and e commerce expansion. These countries are not yet universally recognized as the best country for startups, but they are rapidly building competitive ecosystems that may challenge older markets in the next decade. Singapore functions as the region’s financial and regulatory anchor and remains a key contender in regional rankings.

The Middle East and North Africa as Emerging Competitors

The Middle East is redefining its global role through technology driven national strategies. The United Arab Emirates and Saudi Arabia have established major innovation investment funds, incubated hundreds of startups, and attracted founders from Europe, Africa, and Asia. Dubai’s pro business environment and Riyadh’s Vision 2030 initiatives position the region as a growing force in global entrepreneurship. While not yet universally ranked as the best country for startups, the region’s rapid infrastructure development and strong financial backing make it one of the most promising areas for future growth.

Europe’s Position in a Multipolar Startup Economy

Europe maintains strong innovation ecosystems but faces competitive pressures from Asia and the Middle East. London continues to dominate European fintech. Berlin leads in mobility and deep tech. Paris invests heavily in artificial intelligence and research driven innovation. Stockholm maintains a strong focus on sustainability and SaaS. While these cities demonstrate resilience, Europe’s fragmented regulatory environment presents challenges in the race to be recognized as the best country for startups. Nevertheless, strong education systems, scientific excellence, and stable markets ensure Europe remains highly competitive on the global stage.

The United States and Its Changing Dominance

The United States has historically been viewed as the best country for startups due to Silicon Valley’s enduring influence. However, its global share of venture capital has declined as new regions develop strong innovation capacities. The United States still maintains considerable strengths in talent, research institutions, and capital networks. Cities such as San Francisco, New York, Austin, and Seattle remain powerful engines of global innovation. Yet, the increasing diversification of global entrepreneurship shows that the world no longer relies solely on the United States as the best country for startups. A multipolar distribution of innovation has emerged, reducing the concentration of global influence.

Latin America’s Strategic Shift Toward Technology Growth

Latin America has experienced significant entrepreneurial expansion during the past decade. Brazil, Mexico, Colombia, and Chile have all developed growing startup ecosystems focused on fintech, e commerce, and logistics innovation. Improved digital infrastructure and a more sophisticated venture investment landscape contribute to regional progress. While Latin America is not currently classified as the best country for startups, its accelerated development indicates that it may soon become a more influential player in global rankings.

Framework for Evaluating Future Competitors

Evaluating the best country for startups requires a robust analytical framework that examines economic maturity, technological readiness, cultural support, and policy direction. Nations must adapt to emerging technologies, support digital ecosystems, and maintain strong global talent networks. Countries that fail to embrace these requirements risk losing competitiveness. Researchers often use composite indexes that analyze these factors to identify the most significant competitors for the title of best country for startups.

Global Startup Trends That Influence National Rankings

Several major trends are reshaping the global startup environment. The rise of artificial intelligence, renewable energy technologies, healthcare innovation, and digital finance redefine which countries possess competitive advantages. Nations that invest in these emerging industries improve their chances of becoming the best country for startups. The global shift toward remote work and international founder mobility also impacts national competitiveness. As these trends evolve, countries must adjust their strategies to maintain strong positions in global rankings.

The Importance of International Collaboration

International collaboration plays a critical role in determining the best country for startups. Partnerships between governments, universities, and private sector stakeholders create robust innovation ecosystems. Cross border investment, knowledge sharing, and research cooperation accelerate startup development. A nation that cultivates international networks gains strategic advantages that help elevate its status in global competitiveness indexes. These collaborations influence long term entrepreneurial outcomes and help identify which countries maintain momentum in the search for the best country for startups.

Conclusion

Determining the best country for startups requires careful analysis of economic conditions, innovation capacity, regulatory structure, cultural attitudes, and global investment flows. The modern startup landscape has evolved into a multipolar system with strong contributions from Asia, North America, Europe, the Middle East, and emerging markets. No single nation holds absolute dominance. Instead, competitiveness is distributed across several high performing regions, each offering unique advantages. The countries that adapt to technological transformation, support entrepreneurial growth, and attract global talent will continue to rise in global rankings. The future of the startup economy belongs to nations that combine strategic policy, digital innovation, and strong ecosystem support to become serious contenders for the title of best country for startups.